EXPERIENCE DRIVING VALUE

RESOURCE ASSET INVESTMENTS

QADO offers to private equity, venture capital and consortium investors the breadth and depth of technical and operational expertise needed to make exceptional investment decisions.

With QADO in the team, investor groups can secure and develop opportunities confident that the technical, operational, and management considerations are well understood and optimised.

QADO understands the low-cost development scenarios and lean operating processes required, particularly in low commodity price environments, to maximise asset values and provide meaningful inputs to financial assessment of potential acquisitions or joint venture participation. It then backs this up with the A-team to implement and subsequently manage these processes.

Highly experienced in both operated and non-operated joint ventures, QADO can provide contract operating and asset management capability to owners and JV participants.

In addition, the broad QADO industry network combined with its extensive asset knowledge-base, particularly in Australasia, positions it as a facilitator of linkages between investors, asset purchase opportunities, and indeed other investors.

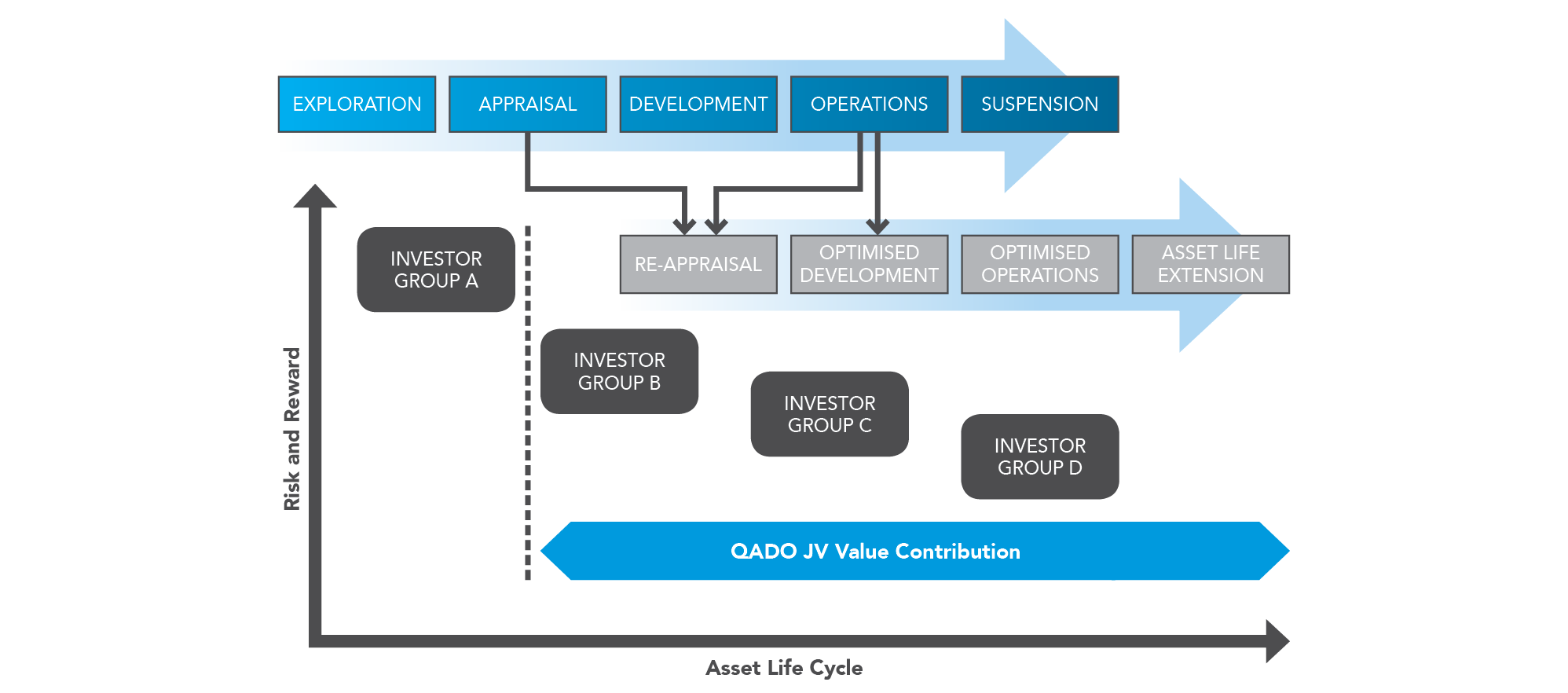

As illustrated below, using a gas field asset as an example, investor groups vary in their appetite for risk as well as their expectations for returns. This risk and reward profile changes as an asset is matured. QADO can assist investors along this pathway or a re-development pathway, aligning their needs with the right asset at the right time, and ideally with the right partners.

RESOURCE ASSET DEVELOPMENT LIFECYCLE